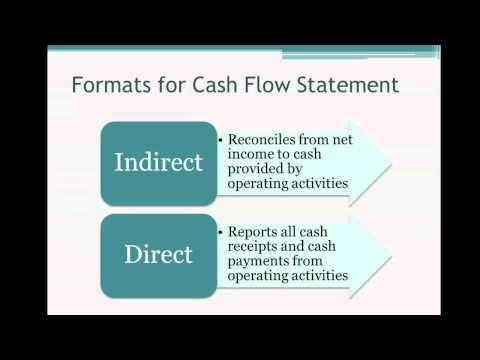

direct vs indirect cash flow format

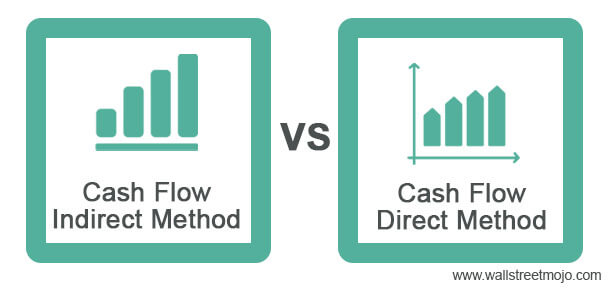

Examples of Cash Flow Statements Direct and Indirect Methods. The direct method discloses information that is not available in any other section of the financial statements.

The Essential Guide To Direct And Indirect Cash Flow

However the indirect method is much easier for a finance team to assemble since it.

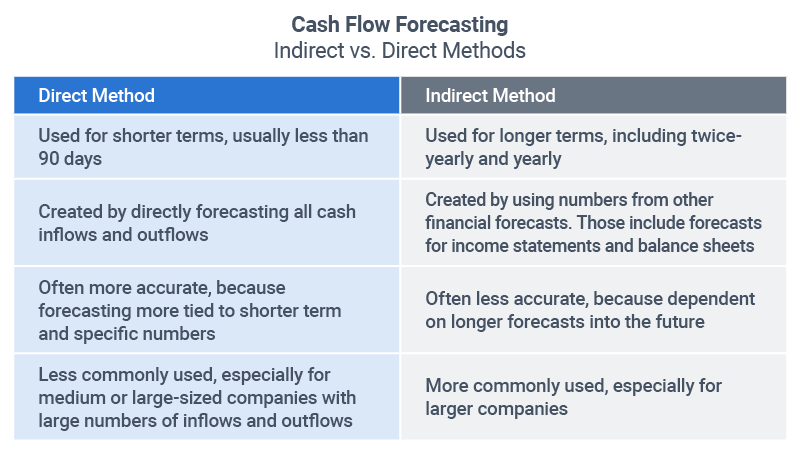

. The indirect method starts with net profits from the income statement. Its faster and better aligned with the way this accounting. The direct method is particularly useful for smaller business that dont have.

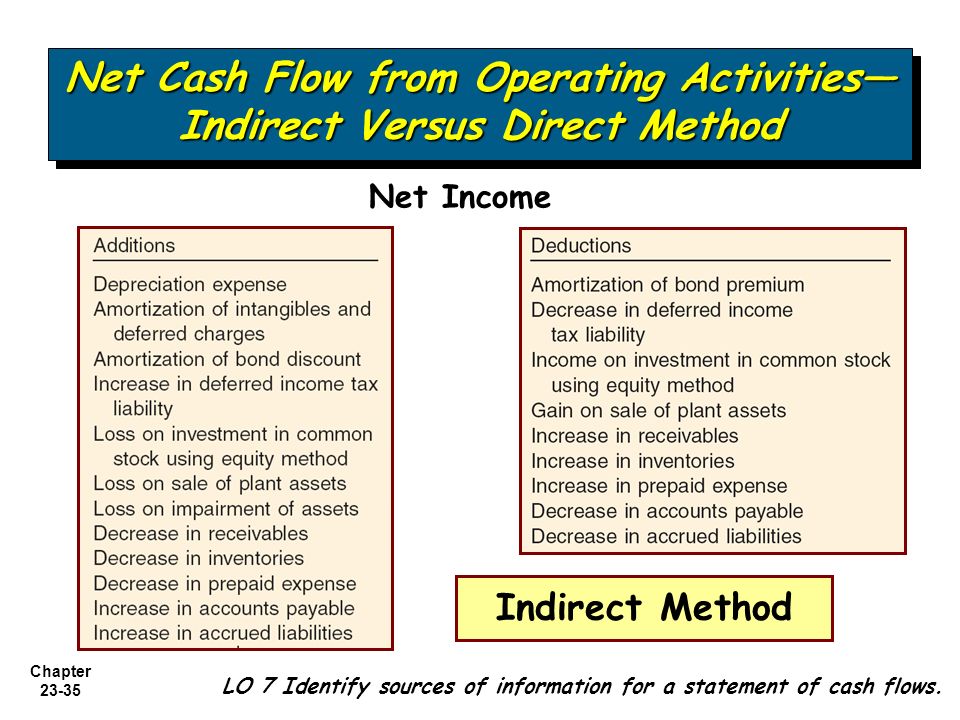

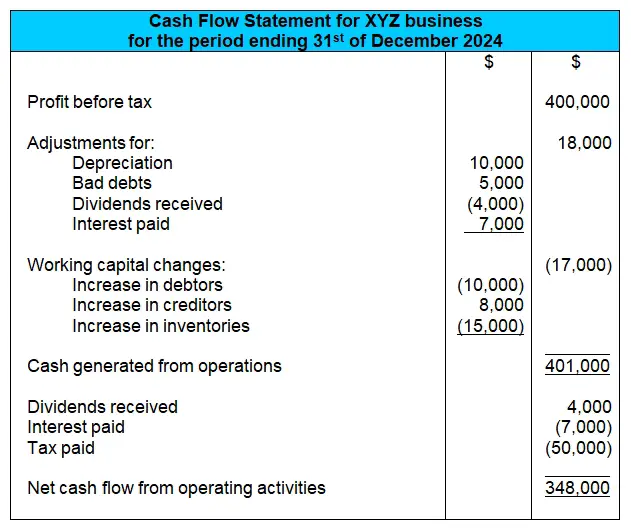

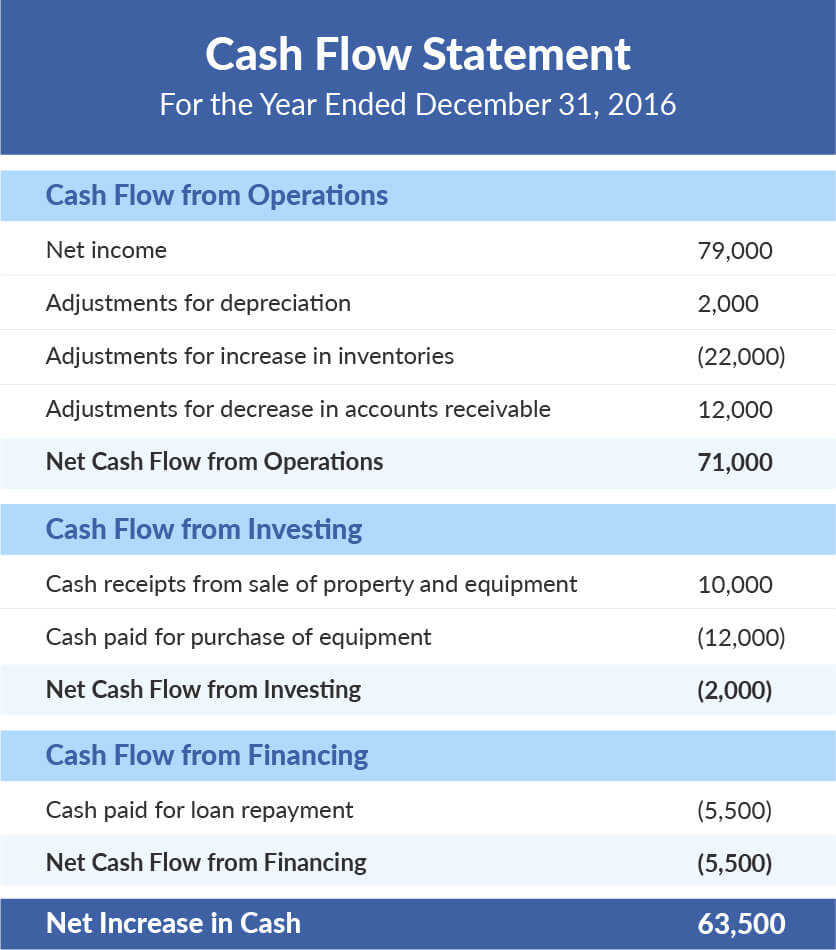

The indirect method of analyzing cash flow allows you to find the net cash flow and establish the relationship between the profit received and changes in the cash balance. This method involves starting with your net incomein other. Indirect method of cash flow statement As the name suggests cash flows from.

The indirect cash flow method makes reporting cash movements in and out of the business easier for accruals basis accounting. The company s cash movement in one period is very important to report in. Direct vs Indirect Cash Flow Methods Top Key Differences to Learn Direct vs Indirect Cash Flow Methods By Rishab Nigam Finance Blog Accounting fundamentals Other Expenses Ex-Dividend.

For professionals it could be a useful tool when making cash flow projections. INDIRECT METHOD The indirect method is the most commonly used method for preparing cash flow statements. The direct method is perhaps the simplest to understand though it is often more complex to calculate in practice.

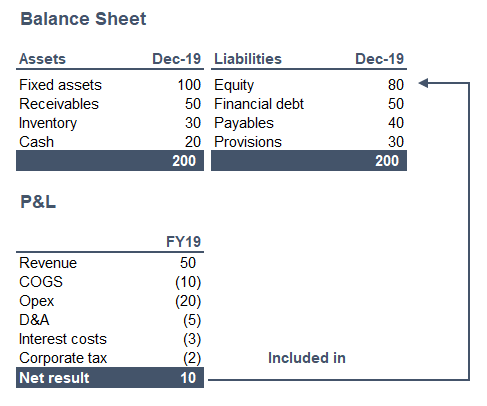

In the direct method of cash flow statement preparation actual receipts from customers and actual payments to suppliers service providers employees taxes etc. The indirect method of cash flow uses accrual accounting which is when you record revenue and expenses at the time a transaction occurs rather than when you actually. The differences between direct and indirect cash flow reports.

The indirect cash flow method uses the same general classifications as the direct cash flow method. Primary distinction between the direct and indirect cash flow statements is that operating activities generally report cash payments and cash receipts occurring throughout. A business cash flow statement shows the companys profits and losses within a given time frame.

Some of the differences between these two formats include the following. The indirect method is widely used by many businesses. From there it adjusts for.

Here is a link to an example of statement of cashflows presented under direct method. It is a simple way of calculating your cash flow and can be done quickly from data readily available in your. This video compares and contrasts the direct method for preparing the Statement of Cash Flows to the indirect method for preparing the Statement of Cash Flow.

The Essential Guide To Direct And Indirect Cash Flow

Statement Of Cash Flow For A Nonprofit Organization Example Uses

/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)

Cash Flow Statements Reviewing Cash Flow From Operations

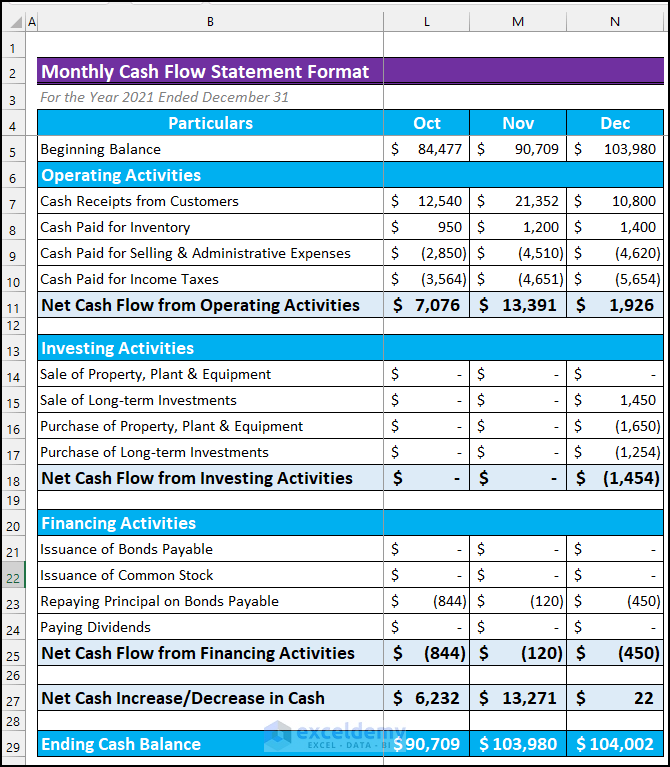

How To Create Monthly Cash Flow Statement Format In Excel

The Essential Guide To Direct And Indirect Cash Flow In 2022 Cash Flow Statement Cash Flow Positive Cash Flow

Statement Of Cash Flows Ppt Video Online Download

How To Prepare A Cash Flow Statement Model That Balances Toptal

The Indirect Cash Flow Statement Method

Direct Vs Indirect Cash Flow Methods Top 7 Differences Infographics

Difference Between Direct And Indirect Cash Flow Compare The Difference Between Similar Terms

Direct Vs Indirect Cash Flow Methods Top 7 Differences Infographics

Cash Flow Forecast Basics Smartsheet

Chapter 17 Statement Of Cash Flows

Cash Flow Statements Examples And Solutions For Your Saas Business Baremetrics

What Is A Cash Flow Statement Financial Statement To Measure Cash

Solved Prepare The Statement Of Cash Flow In Indirect And Chegg Com

Direct Vs Indirect Methods Of Cash Flow Statement Financiopedia

Example Indirect Method Of Cash Flow Statement Financiopedia